About MitchCap: Simplifying Distribution Finance Solutions

Established by Paul Mitchell, former GM of GE Capital CDF Australia and New Zealand, MitchCap stands out as a key player in the distribution finance realm.

Empowering Equipment Dealerships

Understanding the crucial role of Equipment Dealerships in the distribution of equipment, Paul Mitchell set out to bridge funding gaps. In 2018, he kickstarted MitchCap using personal resources, showcasing unwavering commitment.

Strong Financial Backing

MitchCap boast a substantial capital base, its shareholders include renowned institutional investors Balmain Capital and Macquarie Bank along side the founder Paul Mitchell.

Trusted Industry Partner

Endorsed by the sectors it serves, MitchCap proudly serves as the designated floorplan financier for the Boat Industry Association of Victoria, reinforcing its reputation as a reliable financial ally in the distribution finance domain.

Expertise in Floorplan Finance:

With a leadership team that collectively brings over six decades of Floorplan Finance experience in leisure industries, MitchCap solidifies its position as an industry leader, setting new standards of success.

MitchCap's Dealer and Distribution Floorplan Finance

Managing a dealership or distribution business presents unique challenges.

At MitchCap, we support businesses with:

- Distribution and Dealer Finance (CDF) tailored to your business’ needs

- Retail Equipment Finance for flexible purchasing options

- Supplier Payments with integrated foreign exchange solutions

- Financing for new, used, and trade-in inventory

- Competitive floorplan terms designed for your business

- Access to substantial credit capacity to help you grow

Straightforward finance accessible for dealerships and distributors

MitchMarket Finance

Retail Finance Made Simple for Your Customers

We’re here to help you enhance your business with retail finance solutions that deliver real value:

- Boost Your Strike Rate: Access MitchCap and over 30 major lenders to find the right fit for your customers.

- Increase Profitability: Pair our floorplan options with retail finance to enjoy lower rates or higher commissions.

Our integrated ecosystem goes beyond just equipment sales. By connecting with MitchCap’s retail finance solutions, dealers are provided with a fully integrated finance system ensuring the ability to offer convenient, tailored financing options to your customers while streamlining your processes.

MitchMarket

Our online marketplace.

- Is and ALWAYS will be free for MitchCap Bailment Dealers

- Connects prospects and consumers directly to our Dealers

- QUAD Lead Generation with active digital campaign lead magnets

- Boosts Dealership and Brand followers

Distribution Online Portal

MitchCap’s online distribution portal provides the Distributor with:

- Personalised Dealer credit data

- Line of sight to products and dealers

- Reporting that promotes opportunities for growth

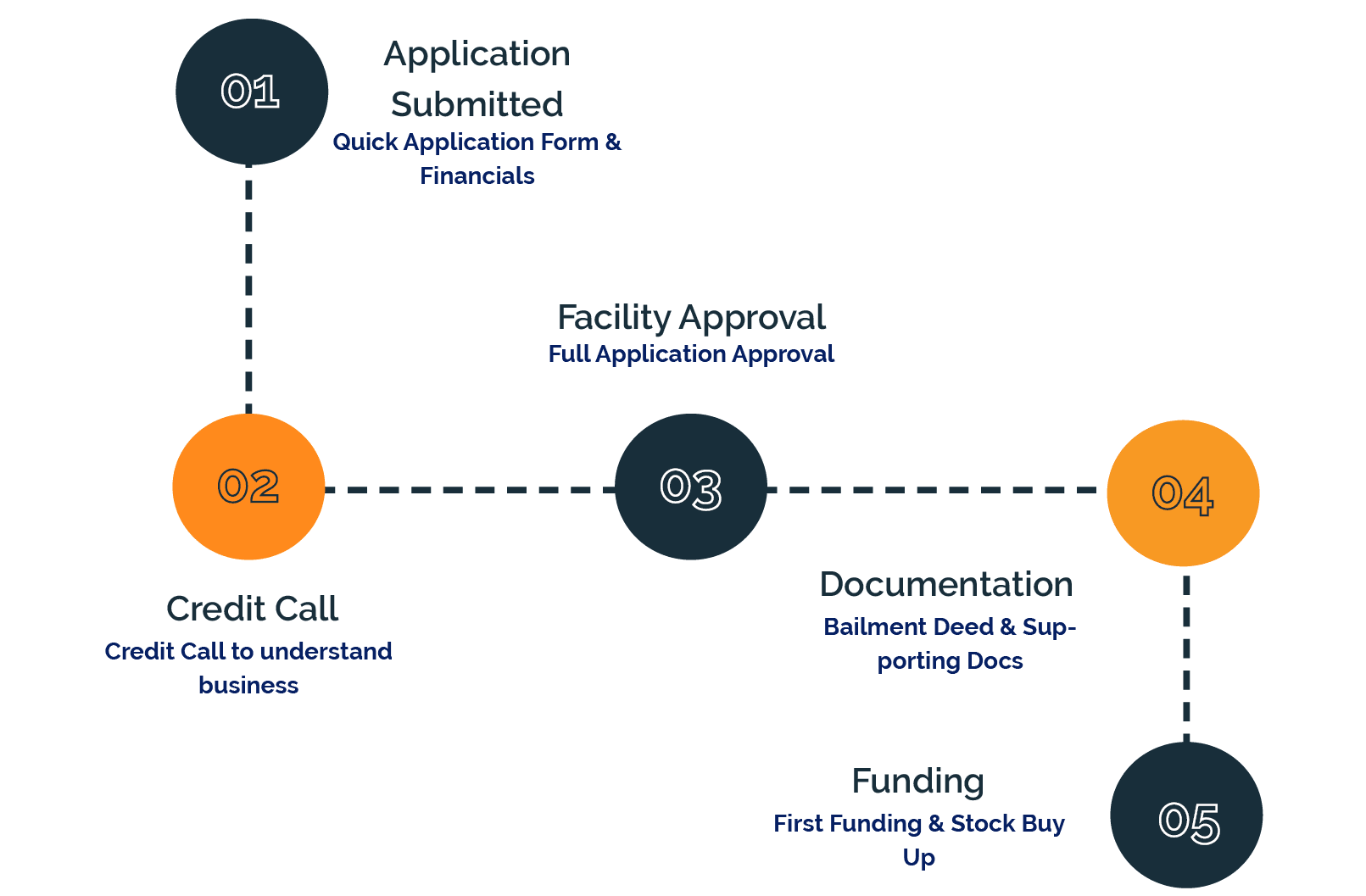

Asset Funding in 4 steps

Step 1: Submit application

Step 2: Credit call to understand your business

Step 3: Application approval

Step 4: Bailment deed and supporting documentation

Step 5: Funding

MitchCap Executive Team

Paul Mitchell

CEO & Founder

Patrick

General Manager (Finance)

Sabbir

Chief Risk Officer

Ariel

General Manager (Ops & Assurance)

Nadia

Head of Marketing & Communications

Bill

General Manager (Sales)

Keria

Head Of Retail Finance

MitchCap Board Members

Paul Mitchell

Andrew Griffin